The race for electric vehicle dominance is heating up, and two names are leading the charge: Tesla and BYD. By 2025, these companies are far more than just carmakers — they’ve become powerful forces driving innovation, reshaping the future of mobility, and shaking up the traditional automotive supply chain.

Tesla continues to turn heads in the West with its cutting-edge technology and high-performance electric sedans. Meanwhile, BYD has grown from a battery maker into a global EV powerhouse, selling millions of affordable electric and plug-in hybrid vehicles around the world. The big question now isn’t if EVs will take over — it’s how fast and who’s going to lead the way.

In this article, we take a closer look at how Tesla and BYD stack up in 2025 — comparing sales, technology, and strategy — and explore what their success means for the rest of the auto industry. We’ll also explain why the rise of EVs doesn’t mean the end for internal combustion engine (ICE) parts — especially in emerging markets, fleet operations, and repair sectors.

Tesla vs BYD: Quick Overview

| Category | Tesla | BYD |

|---|---|---|

| Founded | 2003, USA | 1995, China |

| Global Sales (2024) | ~1.8 million EVs | ~3 million EVs + plug-in hybrids |

| Flagship Models | Model 3, Model Y, Cybertruck | Qin Plus, Han EV, Dolphin, Atto 3 |

| Battery Tech | NCA / LFP (Panasonic, CATL) | In-house Blade Battery (LFP) |

| Autonomous Driving | Full Self-Driving (beta), AI focus | Basic ADAS, limited autonomy |

| Market Strength | North America, Europe | China, Southeast Asia, LATAM, expanding in EU |

| Price Range | Mid to high-end | Entry-level to mid-range |

| Business Model | Direct sales, in-house tech | Vertical integration: batteries, chips, vehicles |

Tesla leads in technology and brand appeal, while BYD dominates with its scale, affordability, and rapid expansion — particularly in cost-sensitive markets.

Who’s Winning the Market in 2025?

As of mid-2025, Tesla and BYD are both reaching impressive milestones. But when it comes to raw numbers, BYD is pulling ahead, thanks to its mix of pure EVs and plug-in hybrids (PHEVs).

Sales Overview: Tesla vs BYD (2024 vs 2025 H1)

| Metric | Tesla | BYD |

|---|---|---|

| Total Sales (2024) | 1.81 million EVs | 3.02 million (1.57M EVs + 1.45M PHEVs) |

| Total Sales (2025 H1) | ~970,000 EVs (estimated) | ~1.56 million (0.82M EVs + 0.74M PHEVs) |

| 2025 EV-Only Sales (H1) | ~970,000 | ~820,000 |

| Global EV Market Share (H1) | ~18–19% | ~16% (EVs only), ~28% (EV + PHEV combined) |

| China Market Share (2025 H1) | ~9% | ~33% |

BYD is selling more vehicles overall, especially when plug-in hybrids are included. Tesla still leads in pure battery EVs, but the gap is closing.

Regional Performance in 2025

| Region | Tesla | BYD |

|---|---|---|

| China | Holds under 10% market share in H1 2025. Competes as a premium EV brand. | Leads with ~33% market share. Dominates domestic EV and PHEV markets. |

| United States | Dominates EV market with Model Y and strong brand loyalty. | Limited presence due to trade restrictions and brand unfamiliarity. |

| Europe | Growing footprint via Berlin Gigafactory and direct sales model. | Expanding fleet and taxi partnerships. Competing on price and efficiency. |

| Latin America & S.E. Asia | Present, but niche market player. Focused on premium imports. | Rapid expansion with affordable EVs and strong government collaborations. |

Despite EV growth, ICE vehicles still make up the bulk of cars on the road — especially in regions where affordability and infrastructure remain barriers to EV adoption.

Technology and Production: Tesla vs BYD

Battery Technology Comparison

| Feature | Tesla | BYD |

|---|---|---|

| Battery Types | NCA (Nickel Cobalt Aluminum), LFP (Lithium Iron Phosphate) | In-house Blade Battery (LFP-based) |

| Battery Suppliers | Panasonic, CATL, LG Energy Solution | Entirely in-house production |

| Innovation Highlight | Introduced 4680 cylindrical cells for higher energy density and output | Blade Battery design improves safety and packaging efficiency |

| Performance Focus | Long-range driving, fast acceleration, energy efficiency | Cost savings, safety, longevity, ease of mass production |

| Application Strategy | High-end models and premium market focus | Mass-market EVs, ride-hailing, taxis, and fleet vehicles |

Tesla prioritizes performance and innovation through collaborations with global battery giants and proprietary formats. BYD, meanwhile, leverages its vertically integrated Blade Battery to scale up production efficiently and cost-effectively.

Manufacturing & Supply Chain Strategy

| Feature | Tesla | BYD |

|---|---|---|

| Factory Locations | U.S. (Austin), Germany (Berlin), China (Shanghai) | China (Shenzhen, Xi’an), expanding in Brazil and Hungary |

| Integration Level | Partial vertical integration; relies on key suppliers for some components | Fully vertically integrated: batteries, semiconductors, EV motors |

| Automation Focus | Strong emphasis on AI, robotics, and proprietary software systems | High manufacturing speed through standardized processes |

| Sales Model | Direct-to-consumer (no dealerships) | Mix of traditional dealerships and government/fleet contracts |

| Partnership Strategy | Charging infrastructure (Supercharger), software partnerships | Strong links with government, taxis, public transit systems |

| Production Speed | Agile, but sometimes limited by supply chain dependency | Faster rollout thanks to complete control of supply and assembly |

Tesla’s approach to manufacturing is centered on innovation and automation, making it a leader in efficiency per unit. BYD, on the other hand, benefits from full vertical integration, allowing it to scale quickly, especially in cost-sensitive markets.

Tesla leads in software sophistication and brand innovation, while BYD wins on speed, cost, and end-to-end control — giving it an edge in scaling up for the global mass market.

What This EV Race Means for the Automotive Industry

The success of Tesla and BYD is not just changing how vehicles are built — it’s transforming the entire automotive ecosystem:

- EVs are projected to make up 60% of new car sales by 2030 in major markets like China, Europe, and the U.S.

- However, more than 1.2 billion internal combustion engine (ICE) vehicles are still on the road worldwide in 2025, many of which will remain operational well into the 2030s.

- Key sectors such as freight, construction, mining, and agriculture continue to rely heavily on diesel and gasoline engines due to their durability, energy density, and serviceability.

- Infrastructure gaps in rural areas, emerging economies, and even certain developed regions mean EV adoption will roll out unevenly across the globe.

This transition period offers both risks and opportunities for businesses in the engine parts sector.

What This EV Shift Means for ICE Vehicles — and the Parts Industry

| Challenge | Opportunity |

|---|---|

| EV growth may reduce long-term ICE part demand in North America, EU, and China | Over 1.2 billion ICE vehicles still require ongoing parts and maintenance |

| Declining production of new ICE vehicles in developed markets | High demand for engine rebuilds in Latin America, Africa, and Southeast Asia |

| Reduced component complexity in EVs (fewer moving parts) | Aftermarket support for aging fleets, export markets, and cost-conscious users |

| Shifting regulations and emissions standards | Extended lifespan of ICEs in off-road, agricultural, and hybrid applications |

In short: ICE vehicles aren’t going away anytime soon — especially in regions where affordability, durability, and existing infrastructure make them the practical choice.

For the parts industry, this means adapting to serve a global demand that remains strong, even as EVs rise in popularity. By understanding regional trends and shifting demand patterns, suppliers can continue to thrive by focusing on markets where ICE remains essential.

Conclusion: EVs Are Rising, but Engines Still Matter

The shift toward electric vehicles is undeniable, with Tesla and BYD shaping the future of mobility. But despite the momentum, internal combustion engines still power over a billion vehicles globally — a reality that won’t change overnight.

From commercial trucks and rural transports to fleets in developing countries, ICE vehicles continue to serve as the backbone of transportation in many regions. The complexity of infrastructure, affordability, and specialized vehicle needs means that engine components will remain in demand for decades.

This transitional period isn’t a threat — it’s an opportunity. Companies that adapt and serve both traditional and evolving markets will be in the best position to succeed.

Why Choose Nanjing Woda for Your Engine Parts Needs

At Nanjing Woda, we understand the needs of the modern automotive industry. As a trusted supplier of engine parts for Toyota, Nissan, Isuzu, and other major brands, we provide our global partners with the reliability and expertise they count on.

With 25+ years of industry experience, we specialize in:

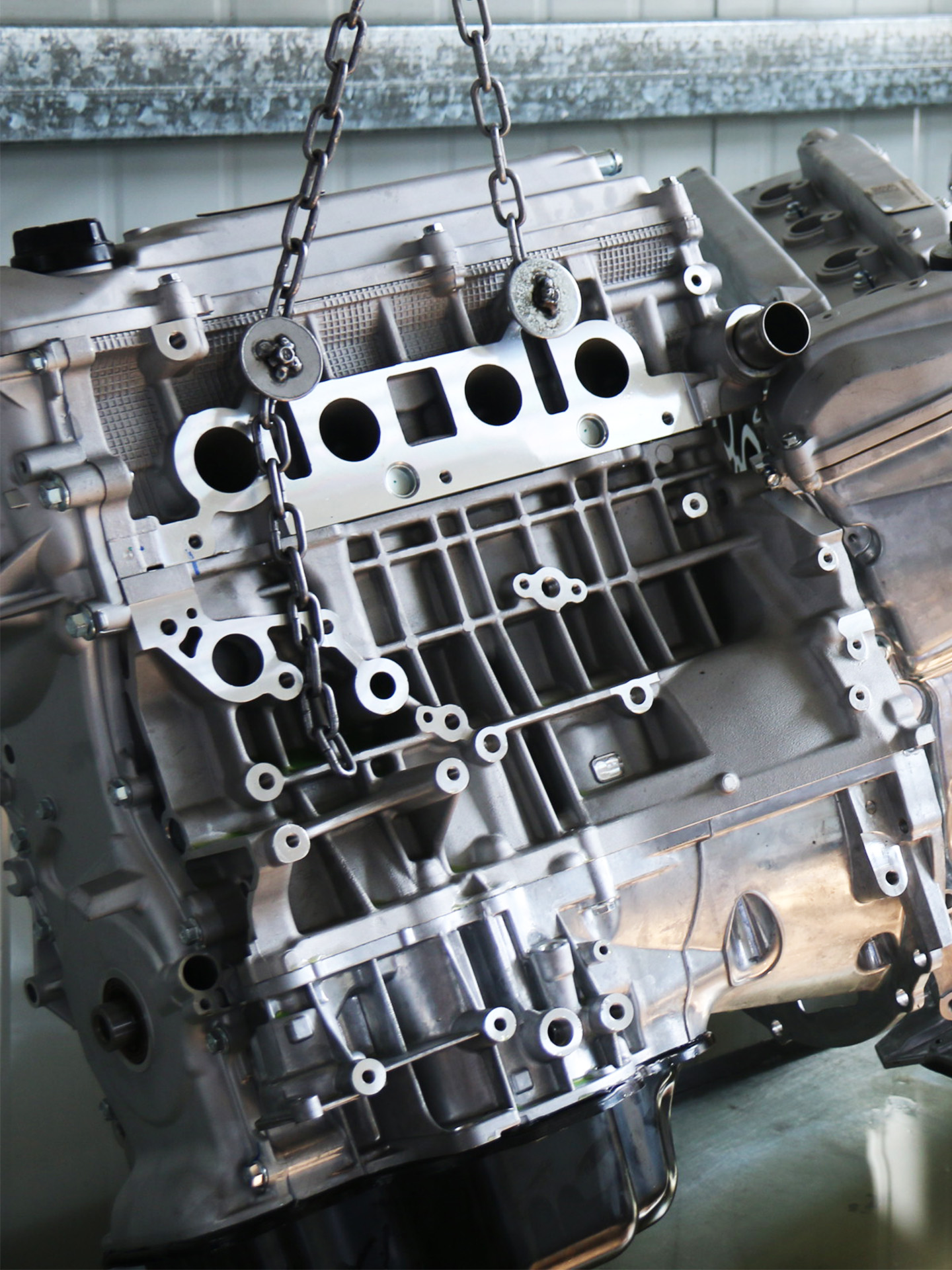

- Complete engine assemblies

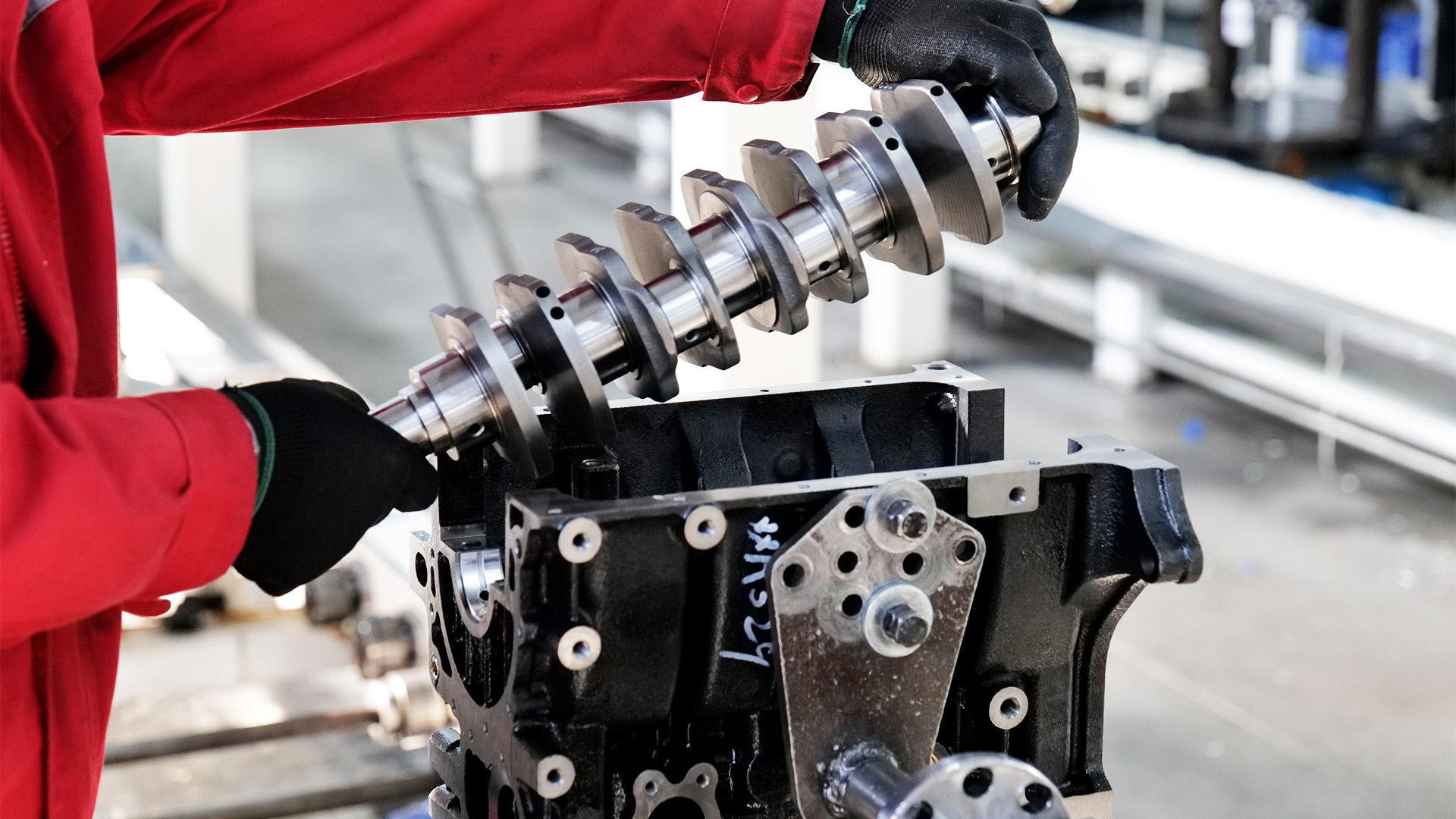

- Cylinder heads and crankshafts

- Camshafts, pistons, and gasket kits

- Tailored support for engine rebuilders, workshops, and fleet operators

We serve B2B clients across Latin America, the Middle East, Southeast Asia, and beyond. Our team is ready to help you source the parts you need — efficiently, affordably, and at scale.

Contact us today to discuss your sourcing needs, request a quote, or explore partnership opportunities.